rsu tax rate texas

Vesting after making over. Unlike actual dividends the dividends on restricted stock will be reported on your W-2 as wages.

How To Avoid Taxes On Rsus Equity Ftw

Local taxing jurisdictions cities counties special purpose districts and transit authorities can also impose up to 2 percent sales and use tax for a maximum combined rate of 825.

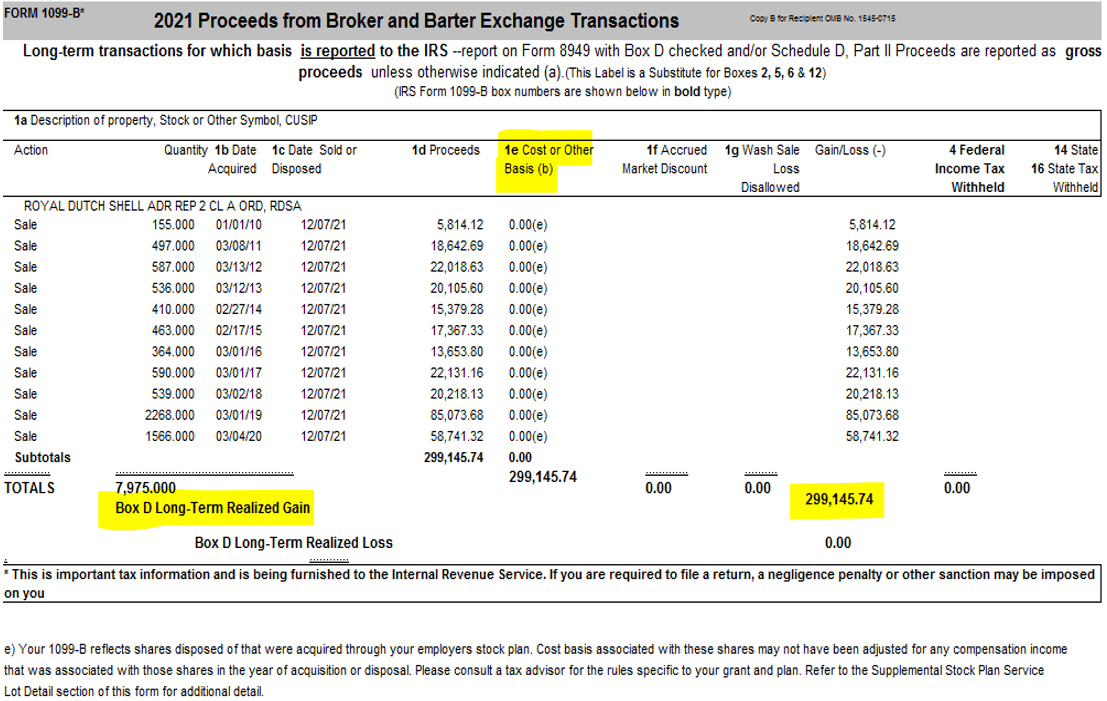

. RSUs can trigger capital gains tax but only if the. Also restricted stock units are subject. However because this person earns.

Vesting after Social Security max. Basic Info for RSU Calculator Shares Granted Vesting Schedule Hypothetical Future Value Per Share Marginal Federal Tax Rate You can use the 2020 brackets below to estimate your tax. Unless you make over 1m in a given year your employer is likely going to withhold taxes for you at a rate of 22.

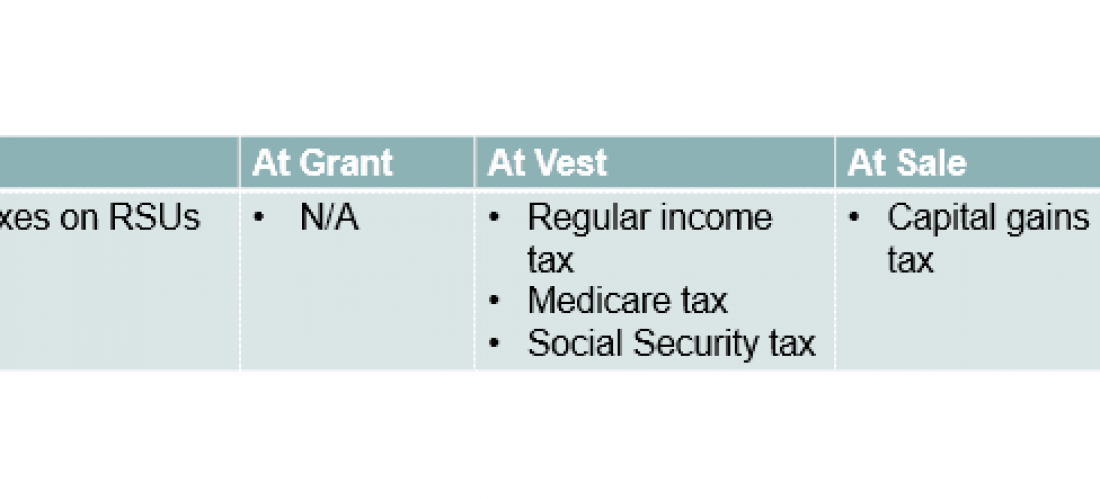

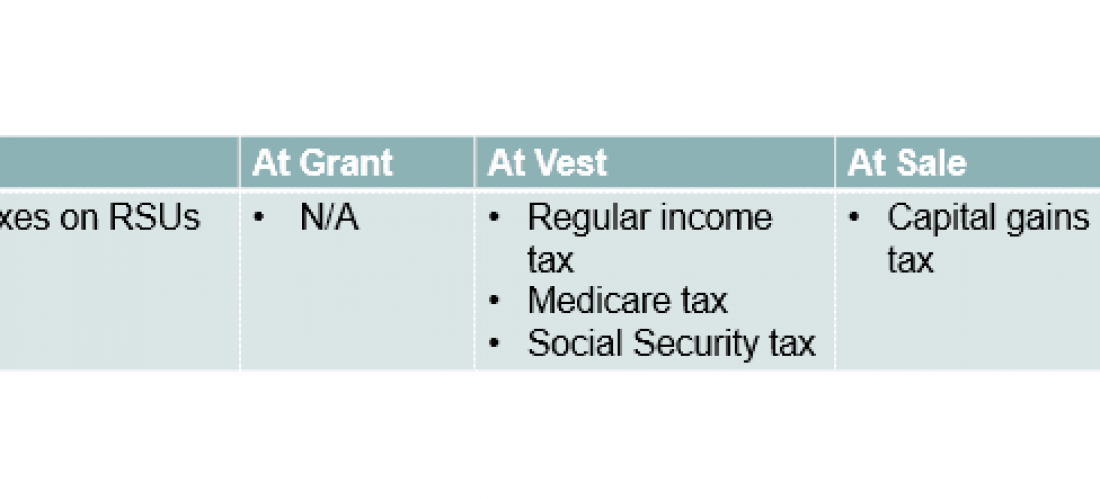

While some stocks are taxed at the date of sale or exercise rsus are taxed at the end of the vesting schedule when they convert to stock. What is the tax rate for an RSU. Companies can and sometimes do pay dividend equivlent payouts for unvested RSUs.

The exact tax rate will. RSUs and Capital Gains Taxes If you sell your stock after your RSUs are converted to shares of the company youll be subject to capital gains tax as well. Vesting after making over 137700.

When you become vested in your stock its fair market value gets taxed at the same rate as your ordinary income. The problem with this is that you might be in a higher tax. RSUs are taxed at the ordinary income tax rate when they are issued to an employee after they vest and you own them.

RSUs are taxed as ordinary income thus the rate that the recipient may pay can range from 10 to 37 depending on the recipients household income. Typically 25 is withheld for federal income tax 62 for SS and 145 for medicare SSmedicare can be different depending on how much income youve received up to. Texas imposes a 625 percent state sales and use tax on all retail sales leases and rentals of most goods as well as taxable services.

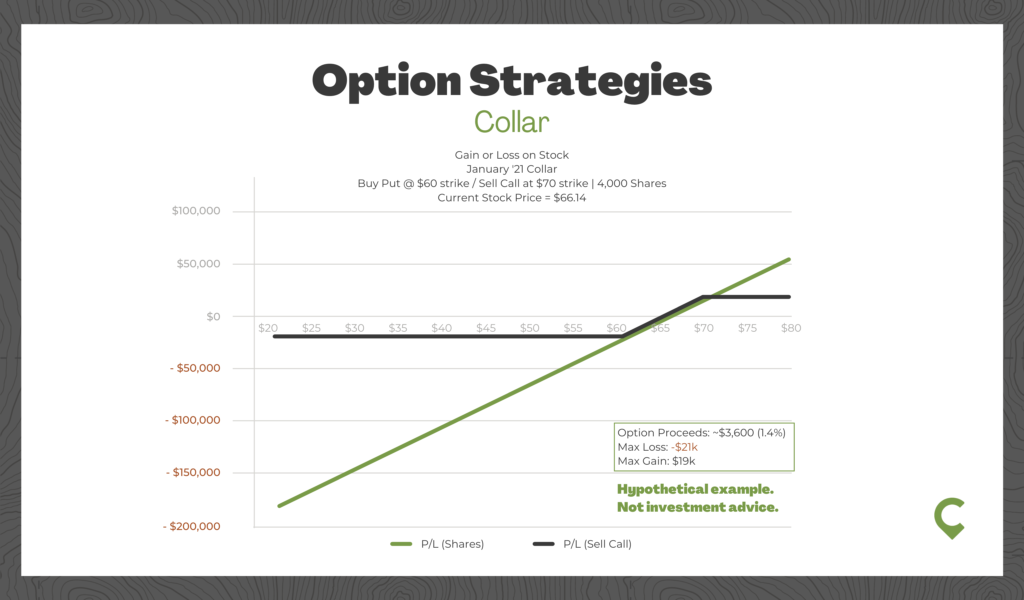

Everything you need to know about Restricted Stock Units how RSUs are taxed and little-known RSU strategies to lower your tax bill in 2022. Skip to main content. If you hold the stock for.

Vesting after Medicare Surtax max. This online calculator allows you to estimate both federal and state taxes due to an IPO or vested RSUs and is especially useful as it takes into account capital gains deductions and existing tax.

How To Avoid Double Taxation On Restricted Stock Units Rsus

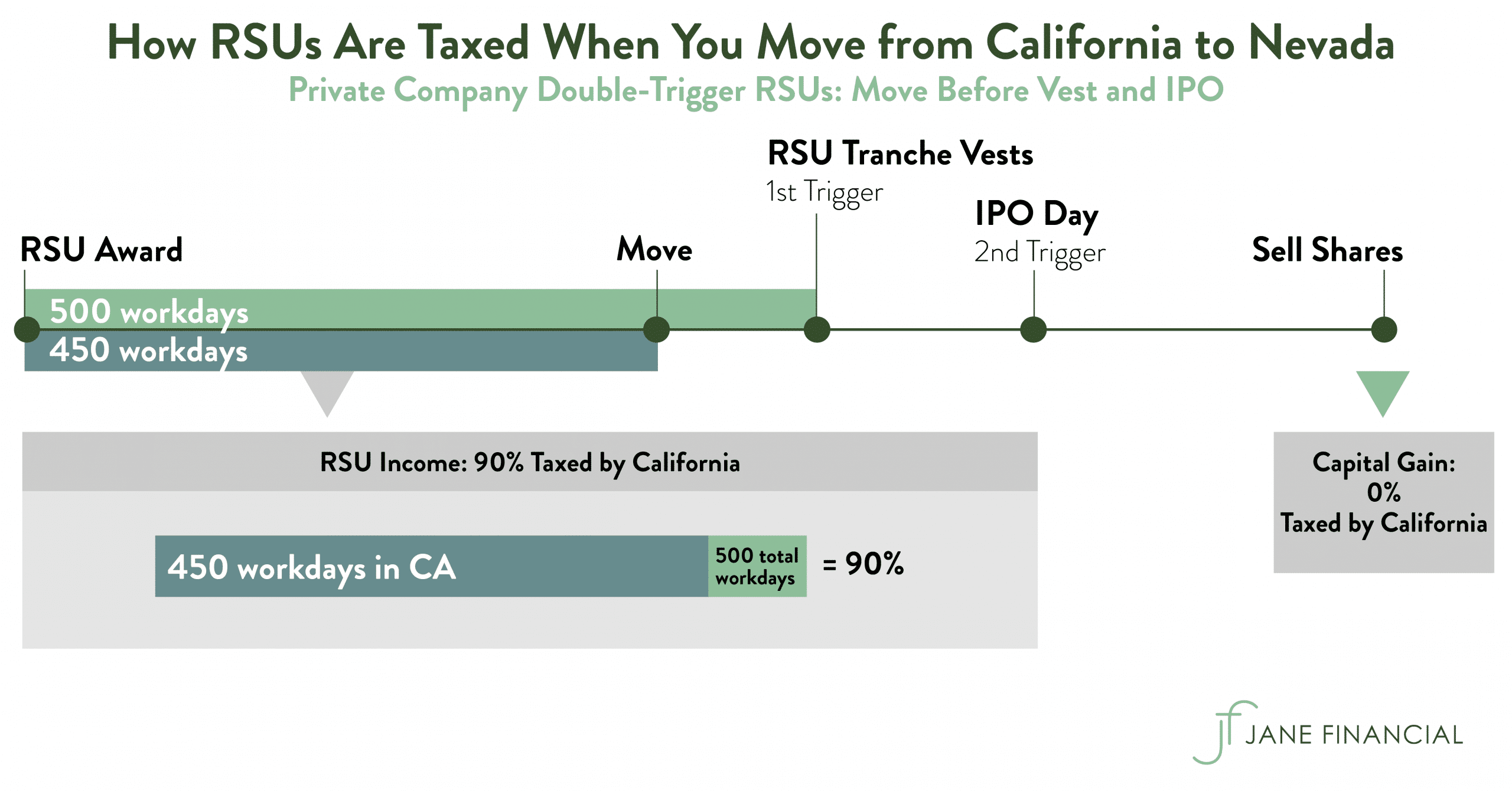

Restricted Stock Units Jane Financial

Rsu Tax How Are Restricted Stock Units Taxed In 2022

Do You Have Restricted Stock Does An 83 B Election Make Sense Hudson Oak Wealth Advisory

How To Avoid Taxes On Rsus Equity Ftw

Rsu Taxes Explained 4 Tax Strategies For 2022

Rsu Taxes Explained 4 Tax Strategies For 2022

Bullard Isd Adopts 2022 23 Budget Sets Tax Rate News Tylerpaper Com

7 Things You Need To Know About Your Restricted Stock Units Rsus X And Y Advisors Inc

What You Need To Know About Restricted Stock Units Rsu Kinetix Financial Planning

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium

Rsu Taxes Explained 4 Tax Strategies For 2022

Rsu Taxes And More Tech Financial Advisor Cpa

Equity Compensation 101 Rsus Restricted Stock Units

Restricted Stock Units Jane Financial

What Is A Restricted Stock Unit Rsu And How Is It Taxed

Are Rsus Taxed Twice Original Post Link By Charlie Evans Medium