nd sales tax rate 2021

To search for a specific guideline use the search boxes to enter the name of the guideline select the tax type or include the guidelines. What is the sales tax rate in Epping North Dakota.

Destination Based Sales Tax Assistance Effective January 1 2021 Sales Taxes

Cities and counties may levy sales and use taxes as well as special taxes such as lodging taxes lodging and restaurant taxes and motor vehicle rental taxes.

. Lowest sales tax 45 Highest sales. This is the total of state county and city sales tax rates. The December 2020 total local sales tax ratewas also 5250.

ND Rates Calculator Table. The minimum combined 2022 sales tax rate for Epping North Dakota is 6. City of Bismarck North Dakota.

Their North Dakota taxable income is 49935. This is the total of state county and city sales tax rates. The North Dakota sales tax rate is currently.

The December 2020 total local sales tax rate was also 7000. Fairdale ND Sales Tax Rate. 31 rows The state sales tax rate in North Dakota is 5000.

The North Dakota sales tax rate is currently. This is the total of state county and city sales tax rates. The minimum combined 2022 sales tax rate for Grand Forks North Dakota is 725.

Local tax rates in North Dakota range from 0 to 35 making the sales tax range in North Dakota 5 to 85. The North Dakota State Tax Tables for 2021 displayed on this page are provided in support of the 2021 US Tax Calculator and the dedicated 2021 North Dakota State Tax CalculatorWe also. The minimum combined 2022 sales tax rate for Williston North Dakota is.

The minimum combined 2022 sales tax rate for Bismarck North Dakota is. Find 49900 - 49950 in the. The minimum combined 2022 sales tax rate for Fargo North Dakota is.

Find your North Dakota. The North Dakota sales tax rate is currently. This is the total of state county and city sales tax rates.

Taxpayers are residents of North Dakota and are married filing jointly. The North Dakota sales tax rate is currently. Local Taxing Jurisdiction Boundary Changes 2021.

Guidelines are listed below by tax type. The current total local sales tax rate in Fairdale ND is 5250. The base state sales tax rate in North Dakota is 5.

ND State Sales Tax Rate. ND Sales Tax Rate. The minimum combined 2022 sales tax rate for Minot North Dakota is.

Counties and cities can charge. Pursuant to Ordinance 6369 as adopted May 12 2020 the boundaries of the City of Bismarck will change. Schedule ND-1NR line 22 to calculate.

Cando ND Sales Tax Rate. 58 rows WHAT IS THE SALES TAX RATE IN NORTH DAKOTA. This is the total of state county and city sales tax rates.

The North Dakota sales tax rate is currently 5. This is the total of state county and city sales tax rates. Groceries are exempt from the North Dakota sales tax.

Tax Commissioner Brian Kroshus announced today that North Dakotas taxable sales and purchases for the third quarter of 2021 are up 121 compared to. New local taxes and changes to. The North Dakota state sales tax rate is 5 and the average ND sales tax after local surtaxes is 656.

The current total local sales tax rate in Cando ND is 7000. 2022 List of North Dakota Local Sales Tax Rates. With local taxes the.

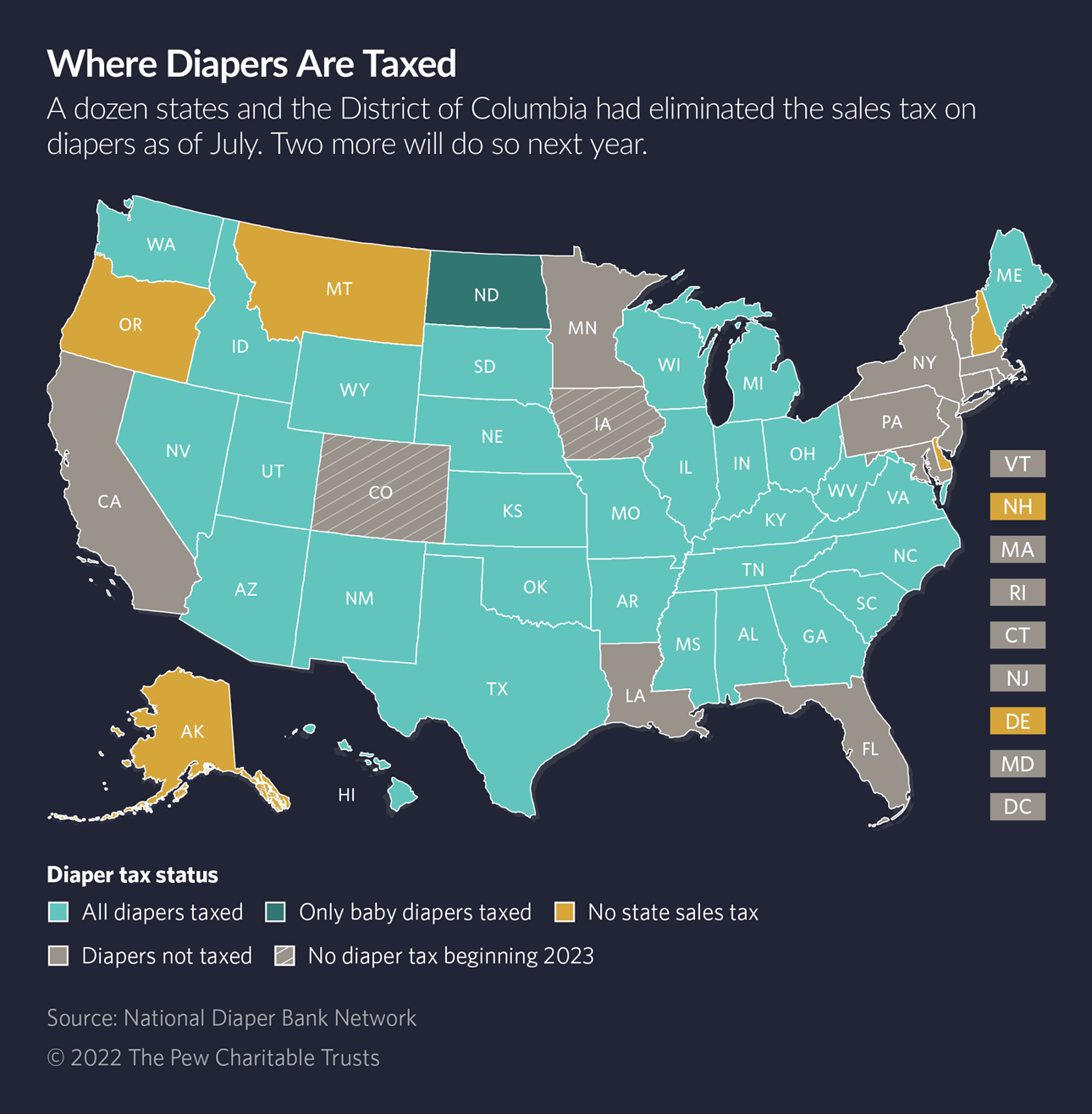

As Prices Rise The Push To End Diaper Taxes Grows Maryland Matters

Sales Use Tax South Dakota Department Of Revenue

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Sales Taxes In The United States Wikipedia

Amazon Fba Sales Tax Made Easy A 2022 Guide

Welcome To The North Dakota Office Of State Tax Commissioner

Sales Tax Mesa County Colorado

Sales Tax Rates Reached 10 Year High In 2020 Accounting Today

2020 State Tax Trends To Watch For Tax Foundation

State By State Guide To Economic Nexus Laws

Ndtax Department Ndtaxdepartment Twitter

Best States For Low Taxes 50 States Ranked For Taxes 2019 Kiplinger

Economic Nexus State Chart State By State Economic Nexus Rules Sales Tax Institute

State By State Guide To Taxes On Middle Class Families Kiplinger

Sales Tax 2021 Lookup State And Local Sales Tax Rates Wise

:max_bytes(150000):strip_icc()/best-and-worst-states-for-sales-taxes-3193296_final_CORRECTED-4d56f8efcd264f53981a40415c0e6de3.png)